Apple, Cisco, Home Depot, Coach, Facebook

8 Oct 2012

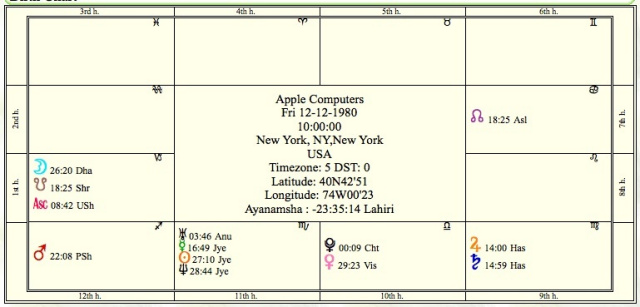

Apple (AAPL)

Victoria: Apple has been hitting all time highs again and with the recent court ruling against Samsung over patient violation, Apple is continuing its take-no-prisoners attitude. Rumors of a new iPhone and smaller iPad debuting this fall have everyone from the media to the markets, and especially consumers waiting breathlessly for the next mind blowing innovation.

Joni: The business looks like it will expand and grow even more. It looks like their technology gets even better and they may introduce some brand new innovations. They will continue to rise in high tech by passing others far and wide. Their market will expand all the more. This will be on an upswing with small ups and owns through next May where they will peak and then there will be a decline downwards.

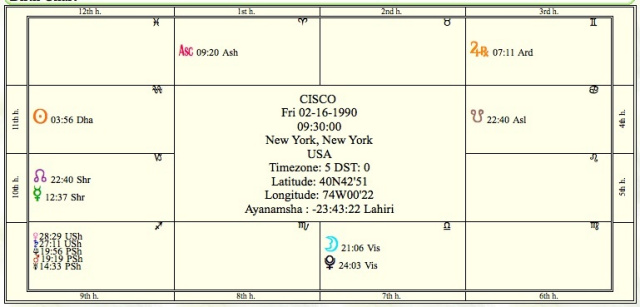

Cisco Systems (CSCO)

Victoria: Not that long ago Cisco held the reputation of a stock that was always a safe bet. Then Apple blew Cisco’s doors off as it zoomed past it and everyone else in the consumer market while other mid-cap tech stocks eclipsed Cisco’s technology in Internet protocol (IP)-based networking in the industy worldwide. Cisco Systems, Inc. took a big market tumble but has since appeared to regain its balance as it once again begins to move forward with innovation in cloud technology and the next generation of digital substation solutions for electrical grids. The question is, can Cisco once again climb to the top of the heap in this industry?

Joni: They are definitely more volatile. They can rise suddenly but fall suddenly. This is a scary ride. They may rise this month but take a tumble next month. They are approaching tough times in November and will do poorly. It is a good time to invest when they tumble downward because they will rise again like the phoenix come next year in the suummer. July and August 2013, they will be riding high. So this is a good stock to invest in now but you must weather the storm, because it will be stormy.

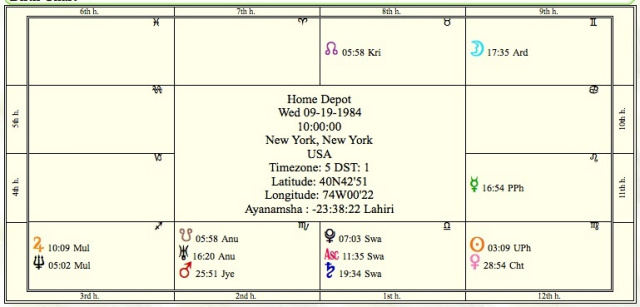

Home Depot (HD)

Victoria: With the Case-Shiller Index showing a definite tick upwards in the top 20 housing markets over the past twelve months, indicators seem to point toward growth for some home improvement stocks such as Home Depot. Certainly since last fall Home Depot has steadily climbed out of its recession pit. The question remains though, is this a sustainable trend?

Joni: Home Depot will trend both up and down but mainly it’s on a downward trend for now. Currently there is a major reversal that will send this stock down. September 13, Mars on Saturn causes a setback to this stock. It can hit a low November 9. December can have a small rise but looks too iffy to me. It will rise some in the spring of 2013, so not all will be lost here.

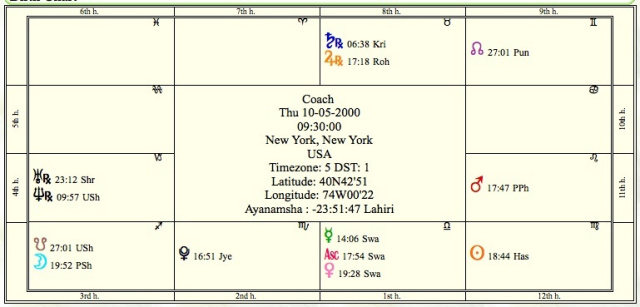

Coach (COH)

Victoria: Coach was one of the first luxury retailers to rally back after the bottom fell out of the market in 2008. It enjoyed a surge that impressed all the analysts up until the end of the first quarter this year. Now the stock has been steadily declining. With Coach being a staple at outlet malls across the U.S., some analysts wonder if this retail strategy is hurting their luxury brand image and what the next year holds for this stock.

Joni: This is a great chart with Mercury and Venus straddling the ascendant, especially since Venus rules beauty and it is in the powerful sign of grace and beauty Libra. Mercury on the ascendant give them great public relations and advertising capabilities. This is a good stock for overall longevity. But October 7, there will be a complication in the financial department and a big loss, so the stock should go way down. Right now it is up and down. But looks like it had a nice rise that was taken back down soon. They will get some bad public relations

in December, but it will maybe stabilize early spring. Steer clear of this stock next summer when Saturn crosses over Venus and aspects the Moon while Jupiter aspects these same planets simultaneously. This will be a very interesting stock to follow as it peaks and valleys over the next year.

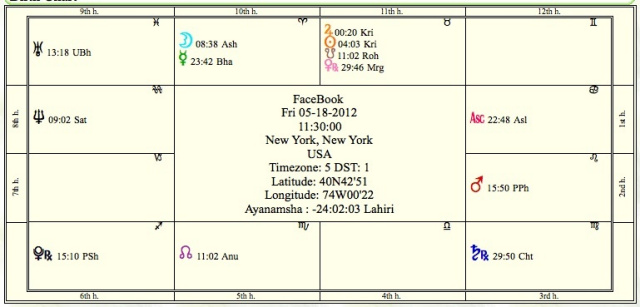

Facebook (FB)

Victoria: Never has an IPO been as botched as Facebook. With so much anticipation leading up to it, and unprecedented last minute releases of additional stock shares coupled with the frenzy of millisecond trading to jockey for an advantage plus a hefty dose of unmitigated greed thrown in for good measure, you undoubtedly have the recipe for disaster and that’s exactly what happened. The stock opened above what the experts thought it would, then instantly started a decline which basically hasn’t stopped since. The dust hasn’t settled yet as young stock is beginning to take it’s first steps. Questions and major concerns over the monetization of Facebook’s mobile app have investors and potential investors in limbo not knowing what to do with this stock.

Joni: They certainly didn't ask an astrologer about the launch date for this stock. Although the delay in the time it hit the stock market improved the chart somewhat, it still looks like a downward trend in this stock. So don't

invest in this one for a while for it will continue on a downward trend. As Ketu, the planet of loss, approaches Jupiter, and Saturn opposes the Moon, they will hit an all time low in December. Then there will have to be some major adjustments and creative new innovations to shift and change this around. The business needs some fresh new ideas to turn this around and it will continue to struggle till they transform it into a new technology with a different approach. All this will transpire around the first of the year and on into spring.